As climate change continues to dominate global headlines, cities around the world are taking aggressive steps to reduce their carbon footprints. New York City, with its iconic skyline and dense urban environment, is no exception. Central to NYC’s climate strategy is Local Law 97 (LL97), a cornerstone of the city’s Climate Mobilization Act. For building owners and real estate investors, understanding and complying with LL97 is not just a legal obligation but a critical step towards sustainable property management.

Local Law 97 Overview

Local Law 97, enacted in 2019, is one of the most ambitious climate laws in the United States. Its primary goal is to reduce greenhouse gas emissions from the city’s largest buildings by 40% by 2030 and by 80% by 2050, relative to 2005 levels. Buildings are the largest source of carbon emissions in NYC, accounting for nearly 70% of the city’s total emissions. LL97 targets these emissions by setting stringent caps on the amount of greenhouse gases that large buildings can emit.

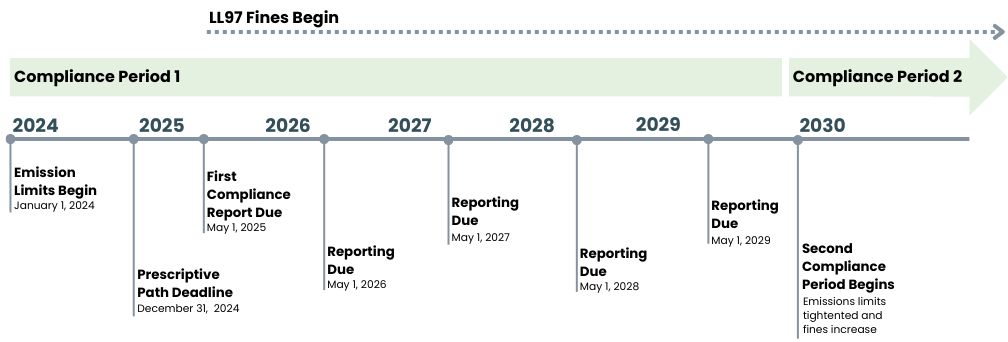

The law requires buildings over 25,000 square feet to meet new energy efficiency and emissions standards, with compliance deadlines starting this year in 2024. Non-compliance can result in significant financial penalties, making it crucial for building owners and investors to understand and meet the requirements.

What Buildings Must Comply with Local Law 97?

Local Law 97 applies to a broad range of buildings, including:

- Commercial and multifamily buildings greater than or equal to 25,000 sq. ft.

- Two or more buildings on the same tax lot that together exceed 50,000 sq. ft.

- Two or more buildings owned by a condo association that are governed by the same board of managers that together exceed 50,000 sq. ft.

- Note: Certain affordable and rent-regulated housing buildings are treated differently and provided with different compliance pathways, however many of these buildings will still need to report their first compliance report in 2025

2024 Penalty Information

Failure to comply with LL97’s emissions limits can result in substantial penalties. As of the latest updates, penalties are calculated based on the difference between a building’s actual emissions and its allowable emissions, multiplied by $268 per metric ton of CO2e (carbon dioxide equivalent). Here’s a breakdown of the key penalties:

-

- Exceeding Emission Limits: For each ton of CO2e emitted above the limit, building owners face a fine of $268.

- Failure to File a Report: Building owners who fail to submit required compliance reports will incur a fine of $0.50 per square foot of the building per month until the report is filed.

- Misreporting or Fraud: Intentional misreporting or fraud can lead to even steeper fines of up to $500k and potential legal action or imprisonment.

GreenGen’s Guide to Local Law 97 Compliance

Navigating the path to LL97 compliance is not a one-time task but an ongoing journey that will span years. It involves continuous evaluation, adaptation, and improvement to meet evolving standards and regulations. This guide offers a structured approach to begin your compliance journey with a few key insights to keep in mind.

- Identify Impacted Assets: NYC Accelerator provides a free tool to look up a building and assess compliance.

- Verify Data Coverage & Accuracy: Ensure comprehensive and accurate whole building data collection through utility APIs, tenant engagement programs, and by leveraging tools like Energy Star Portfolio Manager. Where data is manually reported by tenants it is still a good idea to assess data accuracy. Consider partnering with third-party experts for assessment and verification as required.

- Perform an Energy Audit and Evaluate Improvement Measures: If not already completed, an energy audit is needed to understand a building’s existing carbon emissions and energy usage in order to be used as a baseline. Your energy audit should include:

-

- Assessment of building systems and improvement opportunities for building envelope, lighting systems, HVAC, controls, air quality, resilience, and water use.

- Pathway to compliance that considers energy conservation measures (ECMs), equipment remaining useful life, renewables, green contracts, grid decarbonization plans, and carbon offsets.

- Onsite renewables feasibility assessment as LL97 allows for the deduction from emissions resulting from annual electricity consumption where electricity is generated by a solar energy system on a building’s premises.

- Evaluation of systems for electrification opportunities. Local Law 97 (LL97) provides financial incentives to encourage the electrification of heating, cooling, and domestic hot water systems in buildings. Properties can receive deduction credits for installing and using electric equipment that meets specific minimum efficiency requirements. Buildings that electrify these systems can apply a negative emissions coefficient to the electricity consumed by qualifying equipment installed before 2030, with an even more favorable coefficient for systems installed before 2027. These credits can be used to mitigate penalties up until 2036, offering greater flexibility to buildings that install qualifying equipment earlier.

Almost all buildings will need to electrify at some point to comply with LL97. This includes systems like heat pumps, electric water heaters, electric rooftop units (RTUs), and high-efficiency condensing boilers. An energy audit will help determine when equipment replacement is necessary and evaluate electric systems as replacements for existing ones.

When evaluating ECMs and equipment upgrades, it’s critical to look beyond traditional metrics like payback period or return on investment (ROI). A more holistic approach that includes consideration of risk mitigation and overall asset value creation provides a clearer picture of the benefits. Measures that may initially seem less favorable in terms of ROI could, in fact, offer significant value to the asset over the long term, especially when considering compliance sustainability and future-proofing investments. This evaluation should be tailored to the specific lifecycle stage of the asset, with a particular focus on assets with long-term hold periods.

- Implement ECMs

Adopt a strategic, phased approach to roll out chosen ECMs, keeping in mind the timelines set by LL97, the operational lifespan of current equipment, and any incentives that could offset costs. Aim for proactive compliance — for example, meeting a 2025 deadline means achieving and demonstrating compliance in 2024.

- Consider Alternative Compliance Strategies

If a building owner cannot implement further efficiency measures at a building to meet reduction targets, LL97 offers alternative deduction options owners can do to help comply:

-

- Purchasing Renewable Energy Credits (RECs)

- Emission reductions are only attributed to the consumption of utility-supplied electricity

- A RECs renewable energy resource must be located in or whose output directly sinks into New York City grid (Zone J) – these are called Tier 4 RECs

- Challenges:

- Tier 4 RECs will not be available until ~2026 or 2027

- Projected costs for Tier 4 RECs are projected to range from $23.36/MWh to $32.01/MWh

- Purchasing GHG Offsets

- During the first compliance period 2024-2029, up to 10% of a building’s annual emissions limits can be deducted with the purchase of offsets

- Challenges:

- Currently only available for the first compliance period

- GHG offsets will require verification by an independent, qualified third party

- Purchasing Renewable Energy Credits (RECs)

Explore options like Renewable Energy Credits (RECs) and GHG offsets with caution, recognizing that they may not be accepted as an alternative compliance pathway according to some regulations, or provide the long-term value that direct investments in building efficiency and sustainability would.

- Monitor, Report & Verify

Comply with LL97 reporting requirements referenced in the timeline above

Financial Incentives and Support for Compliance

When considering approaches, it’s essential to factor in the risk, cost of inaction, and potential fines into the business case. Reframing the thought process from “how much will this cost me?” to “how much value will this create?” is crucial to quantifying long term impacts of energy efficiency investments and compliance. Additionally, there are many financing opportunities, incentives, rebates, and grants available to help NYC building owners and investors take action today without needing upfront capital:

- Property Assessed Clean Energy (PACE) Financing: NYC Accelerator PACE financing enables long-term, fixed-rate financing, covering up to 100% of project costs with no cash up-front.

- Utility Incentive Programs: Utilities like Con Edison and National Grid offer various rebates and incentives for energy efficiency improvements.

- Federal Tax Credits: The IRA includes tax credits that could account for roughly $625 million in value for buildings doing LL97 compliance work.

- NYSERDA Programs: NYSERDA offers a range of programs and incentives for energy efficiency and renewable energy projects.

- DOE Loan Programs Office: LPO’s Title 17 Clean Energy Financing Program provides loan guarantees for projects that support clean energy deployment and energy infrastructure reinvestment in the United States.

Local Law 97 in Action

Local Law 97 in Action

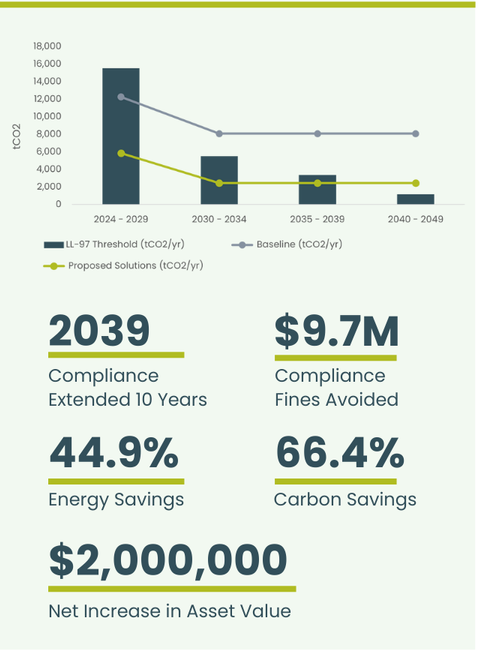

One client with a large property of over 2 million sq. ft. in Times Square engaged GreenGen to assess and develop a plan to address aging equipment and ensure LL97 compliance. It was determined that the property was compliant through 2029 but will not comply with round 2 targets beginning in 2030 and could face penalties upwards of $688,000 per year starting in 2030 and $1.26 million beginning in 2035. While many best practices are in place, the asset’s benchmarked Energy Use Intensity (EUI) is higher than ASHRAE’s median and target EUI for similar buildings, indicating opportunities for efficiency improvements.

After auditing the building, GreenGen recommended a strategic blend of energy efficiency initiatives and capital investments based on the unique asset characteristics. Proposed solutions included installing LED lighting, implementing variable frequency drive (VFD) controllers, and integrating solar photovoltaic (PV) systems. The plan also called for system upgrades including electric chillers, heat pump and water heater upgrades, and an indoor air quality monitoring system. Upon completion of implementation, these recommendations are expected to maintain the property’s compliance through 2039, avoiding estimated fines of approximately $9.7 million from New York City.

Leading the Way in Sustainable Building Practices

LL97 sets a strong precedent and is just one of many Building Performance Standards (BPS) being enacted across the nation to curb carbon emissions from our built environment. As we navigate the rapidly changing regulatory landscape, it’s crucial to consider not only compliance requirements but also the value derived from integrating sustainable practices into the full real estate lifecycle.

For a more detailed breakdown of new Building Performance Standards – including in Boston, DC, and Seattle, download GreenGen’s BPS Guidebook for Real Estate Professionals →

At GreenGen, we specialize in guiding organizations through regulatory landscapes while championing sustainable integration across portfolios. With expertise integrating energy, real estate, capital markets, and technology, we craft turnkey solutions that make decarbonization profitable. For help with:

- Detailed energy audits, benchmarking, and compliance reviews

- Recommended action plans built around a business case

- Implementation of energy upgrades

- Support with incentives and financing opportunities

Reach out to the GreenGen team today: